Introduction to the Healthcare Revenue Cycle

What is the Healthcare Revenue Cycle?

The healthcare revenue cycle is the financial heartbeat of any medical institution. It’s the system that keeps the lights on and ensures healthcare providers are paid for their services. But what exactly does that mean? At its core, the revenue cycle refers to the entire process of managing a patient’s financial journey — from the moment they schedule an appointment until the provider receives full payment for services rendered.

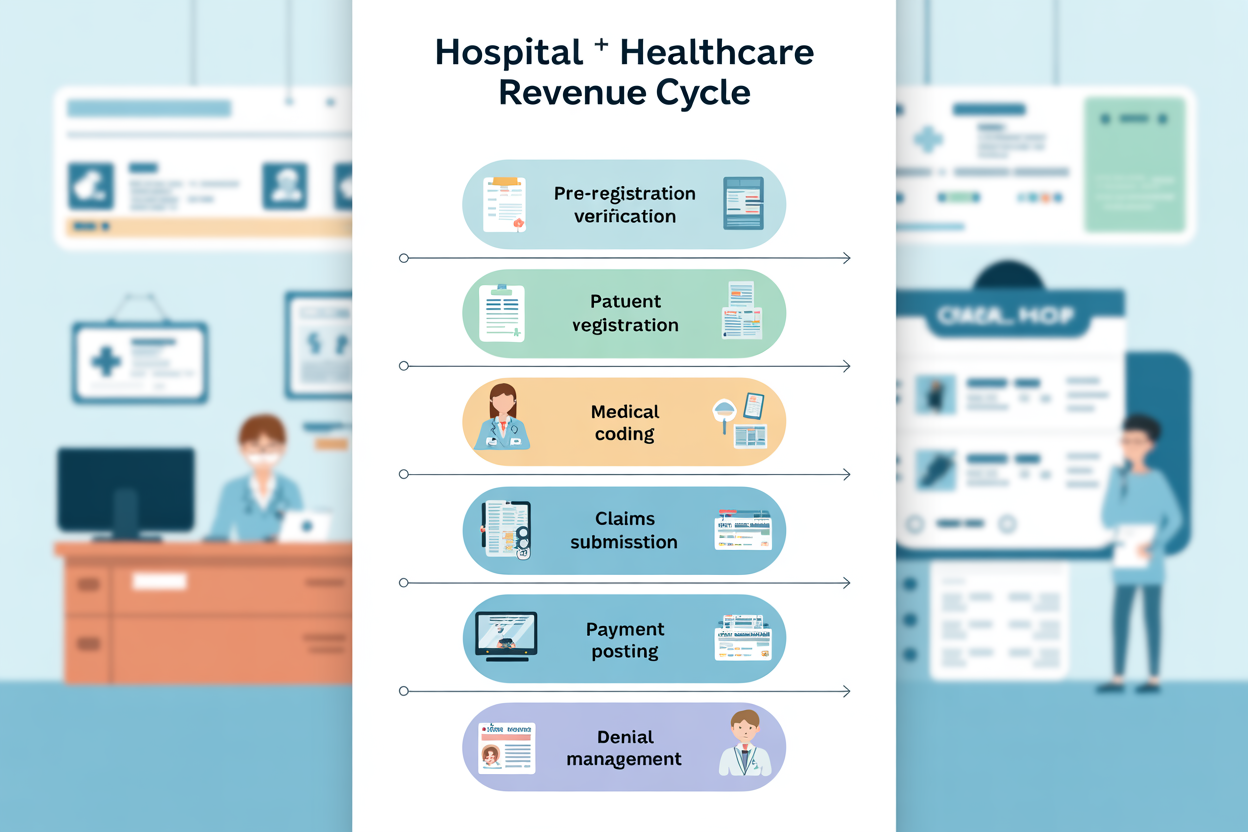

Think of it like a long chain of interlinked tasks: registration, insurance verification, coding, billing, claims submission, payment posting, and follow-up. Every single link must work smoothly to ensure timely reimbursement. If one part breaks, like a denied insurance claim or incorrect coding, the whole process can slow down — or even stall entirely.

In today’s complex healthcare landscape, this cycle is no longer just about billing and collections. It’s become a strategic function that blends administrative tasks with clinical care, IT systems, and data analytics. Hospitals and clinics now view the revenue cycle not as a back-office operation but as a vital part of delivering sustainable healthcare.

For someone new to the industry, the terms and acronyms can be overwhelming — CPT, ICD-10, EHR, RCM. But don’t worry. Understanding the revenue cycle doesn’t require a medical degree. All it takes is a solid grasp of the basics, which is exactly what this guide aims to provide.

So, whether you’re a new healthcare administrator, a medical billing student, or just curious about how your hospital bills get paid, this beginner’s guide will walk you through everything you need to know — step by step.

Why It’s Crucial in Modern Healthcare

In a world where healthcare costs are rising, and reimbursements are tightening, managing revenue has never been more critical. The healthcare revenue cycle is directly tied to the financial stability of medical practices, hospitals, and clinics. If the cycle is mismanaged, even a busy hospital can suffer severe financial losses.

But it’s not just about the money. A well-managed revenue cycle also improves patient satisfaction. Imagine going to a doctor, only to be hit with a surprise bill months later — frustrating, right? Now imagine a smooth billing process where everything is transparent, timely, and easy to understand. That’s the goal of efficient RCM.

Modern healthcare is heavily data-driven, and every step of the revenue cycle generates valuable information. This data can be used to identify trends, reduce denials, improve patient care, and make smarter business decisions. In short, a healthy revenue cycle isn’t just a business advantage — it’s essential to delivering high-quality care in a sustainable way.

Now let’s break it down and look at each stage of the healthcare revenue cycle in detail.

Key Stages of the Healthcare Revenue Cycle

Step 1: Pre-Registration and Patient Scheduling

Before a patient even steps into a clinic or hospital, the revenue cycle has already started. It all begins with pre-registration and scheduling — the foundation for the entire financial process. During this phase, front-desk staff gather basic demographic information, verify insurance coverage, and set up appointments.

This may sound straightforward, but there’s more to it than meets the eye. Accurate pre-registration is essential for preventing errors down the road. A single mistake in entering an insurance policy number or misspelling a name can cause claim denials or payment delays. That’s why many healthcare facilities invest in training their administrative staff or use automated systems to streamline the process.

Effective scheduling also impacts revenue. For example, if patients are double-booked or don’t show up, it leads to lost income and wasted time. That’s why many providers now use patient reminder systems via text, email, or phone to reduce no-shows.

Additionally, this is the phase where patient eligibility is checked — verifying whether their insurance will cover the services and what co-pays or deductibles apply. It’s about setting the financial expectations upfront so that there are no surprises later.

One of the best practices here is providing a financial estimate during pre-registration. It not only helps the patient plan their payment but also improves the likelihood of collecting the payment upfront — reducing the chances of bad debt.

In short, pre-registration and scheduling may seem administrative, but they are essential to both the patient experience and the financial health of a healthcare organization.

Step 2: Insurance Verification and Eligibility Checks

This step can make or break the entire revenue cycle. Insurance verification is the process of confirming that a patient’s insurance is active, current, and sufficient to cover the services they’re about to receive. It involves checking with insurance payers to ensure coverage limits, benefits, co-pays, deductibles, and authorization requirements.

Let’s say a patient comes in for a routine MRI. If insurance verification isn’t done properly, the provider might later find out that pre-authorization was required and wasn’t obtained. The result? The claim gets denied, and the provider either has to write it off as a loss or bill the patient directly — leading to dissatisfaction and potential legal issues.

To avoid such issues, most healthcare facilities use electronic eligibility verification systems integrated with their practice management software. These tools can check benefits in real-time, reducing human error and speeding up the process.

But it’s not just about checking coverage — it’s also about documenting it. Staff should keep a record of all insurance verification efforts, including the name of the representative spoken to, date, time, and outcome. This documentation is vital for defending claims in case of denials.

Moreover, understanding the specific nuances of different insurance policies — such as Medicaid, Medicare, private insurers, or employer-sponsored plans — is critical. Each has its own rules, forms, and timelines.

The better the insurance verification, the smoother the rest of the revenue cycle flows. It’s like tightening the bolts before a race — making sure everything is aligned for a smooth ride ahead.

Step 3: Patient Registration and Data Collection

Patient registration is the next step and goes beyond simply jotting down a name and address. This is where detailed data collection happens — including personal info, insurance details, medical history, emergency contacts, and consent forms.

Why does this matter? Because every bit of information here feeds into the billing system. An error in entering the patient’s insurance group number or policyholder name can lead to denied claims. Misspelling a name or entering the wrong date of birth can throw the whole process off course.

During registration, front-desk staff also obtain patient signatures for treatment consent, privacy policies, and financial responsibility. These aren’t just formalities — they’re legal necessities that protect both the provider and the patient.

Some organizations now use digital intake forms to reduce paperwork and improve accuracy. Patients can fill out their information from the comfort of home before their appointment. This not only saves time at check-in but also allows for data validation before services are rendered.

Accurate registration is more than just good practice — it’s essential. If done correctly, it sets the entire revenue cycle on a smooth, successful path.

Step 4: Charge Capture and Medical Coding

This is where clinical meets financial. After a patient is treated, all the services provided need to be translated into billable codes. That’s the job of medical coders, who use standardized coding systems like ICD-10 for diagnoses and CPT/HCPCS for procedures.

Accurate charge capture is vital. If a service isn’t documented or coded correctly, it might never be billed — and the provider loses money. Worse, incorrect coding can result in claim denials or audits, especially from Medicare or other strict payers.

Here’s a quick example: If a doctor performs a physical exam and a minor surgery but only documents the exam, then only that part gets billed. That’s lost revenue. Coders work closely with clinical staff to ensure all services are properly documented and captured.

Today, many healthcare organizations use electronic charge capture systems linked to their EHR (Electronic Health Record). These tools help ensure that every service, test, or procedure is billed accurately and promptly.

But coding isn’t just about numbers. It also ensures compliance. Accurate coding prevents fraud, supports quality reporting, and even impacts a hospital’s reputation through performance metrics.

The takeaway? Charge capture and medical coding might seem like behind-the-scenes work, but they are the engine that drives healthcare finances.

Step 5: Claims Submission to Payers

Once everything is coded and charges are captured, it’s time to submit the claim to the payer — whether that’s Medicare, Medicaid, a private insurer, or a workers’ comp provider. This step involves converting the clinical and billing data into a standardized claim form (usually a CMS-1500 or UB-04) and sending it electronically to the appropriate payer.

But submitting a claim isn’t as simple as hitting “send.” Claims must be clean — meaning error-free, complete, and in the correct format. Even a small mistake can lead to denials or rejections, which then require rework and delay payment.

That’s why most healthcare facilities use claims scrubbers — software tools that check for errors, missing information, or compliance issues before submission. These tools drastically reduce the chances of denial and speed up reimbursement.

Timeliness is also crucial. Most payers have deadlines for when claims must be submitted. Miss the window, and the claim might not be paid at all.

In essence, this step is the final handoff — the baton pass from provider to payer. Done correctly, it sets the stage for timely and full reimbursement. Done poorly, it can derail the entire revenue cycle.

Managing Denials and Rejections

Common Reasons for Claims Denial

Denials can feel like a punch to the gut — especially when you’ve followed all the steps and still don’t get paid. But the reality is, denials are a common part of the healthcare revenue cycle. According to industry reports, nearly 10% of claims are denied on the first submission, and many of those denials are preventable.

So, what causes claims to be denied?

Here are some of the top culprits:

- Incorrect patient information: A misspelled name, wrong date of birth, or insurance ID number can lead to an automatic denial.

- Missing or incorrect codes: If CPT, HCPCS, or ICD-10 codes are incomplete, outdated, or inaccurate, the claim can be rejected.

- Lack of authorization or referral: Many insurance plans require pre-authorization for services like surgeries, MRIs, or specialty visits. Missing this step is a costly mistake.

- Duplicate claims: Submitting the same claim more than once — even by accident — will often result in a denial.

- Expired eligibility: If the patient’s insurance coverage ended or changed, the claim won’t go through.

- Non-covered services: Some services may not be covered under the patient’s plan, or they might fall outside the payer’s policies.

Understanding the reasons behind denials helps in crafting better preventive strategies. It’s like finding the leak before the boat sinks.

By analyzing denial trends and root causes, healthcare providers can fix issues at the source — whether that’s through better training, improved software, or clearer communication with patients and insurers.

The good news? Most denials are avoidable with the right systems in place. And that’s where denial management comes in.

Strategies for Effective Denial Management

Denials are frustrating, but they don’t have to be final. With a solid denial management strategy, healthcare providers can appeal, correct, and even prevent future issues.

Here’s how to do it right:

1. Identify the patterns: The first step in denial management is understanding why claims are being denied. This involves tracking denial codes, categorizing issues, and identifying common themes.

2. Train your team: Educate front-office staff, coders, and billers about the most frequent errors that lead to denials. A well-informed team is your first line of defense.

3. Automate where possible: Use practice management systems and denial tracking software to streamline appeals and re-submissions. These tools can flag potential problems before claims are submitted.

4. Act quickly: Time is of the essence. Most payers have strict windows for filing appeals — typically 30 to 60 days. Set up workflows to respond to denials as soon as they come in.

5. Improve documentation: Encourage providers to be thorough and precise in their documentation. Better records mean stronger cases for appeals and fewer errors during coding.

6. Communicate with payers: If a claim is denied, don’t just resubmit blindly. Call the payer, ask for clarification, and gather all necessary details before re-filing. Building strong relationships with payer reps can also help speed up resolutions.

7. Monitor and report: Regularly review your denial rates and set benchmarks for improvement. Share progress with your team and celebrate wins — even small ones.

Denial management isn’t just a billing department responsibility — it’s a team sport. And when done right, it can lead to faster payments, fewer write-offs, and a healthier revenue cycle overall.

Payment Collection and Reconciliation

Understanding Patient Billing and Collections

Billing a patient isn’t just about printing an invoice. It’s about communication, trust, and accuracy. In today’s high-deductible health plan world, more financial responsibility is being shifted to patients — making patient billing and collections one of the most critical phases of the revenue cycle.

Here’s what a strong patient billing process should include:

- Clear estimates upfront: Patients should receive a cost estimate before services are rendered, so they’re not blindsided by unexpected bills.

- Simple, easy-to-read statements: Avoid confusing jargon and break down charges clearly. Use everyday language — not codes and abbreviations.

- Multiple payment options: Offer online portals, payment plans, and financing to make it easier for patients to pay.

- Proactive communication: Don’t wait until the bill is 90 days past due. Use emails, texts, and phone calls to remind patients and offer support early on.

- Financial counseling: Trained staff can help patients understand their insurance, identify assistance programs, and set up manageable payment plans.

Collections can be tough, especially when dealing with large balances or patients facing financial hardship. But aggressive collection tactics can backfire and damage trust.

Instead, think of collections as a customer service opportunity. The goal is to educate, assist, and work collaboratively with patients — not just chase payments.

Many providers also partner with revenue cycle outsourcing firms or use revenue cycle management (RCM) software that automates billing and collections, reducing manual errors and speeding up the process.

The bottom line? Patient billing isn’t just a financial issue — it’s part of the overall patient experience. A transparent, supportive billing process builds trust and ensures long-term sustainability.

Explanation of Benefits (EOB) and Remittance Advice

Once a claim is processed by the payer, both the provider and the patient receive documents explaining what was covered and paid — the Explanation of Benefits (EOB) for patients and Remittance Advice (RA) for providers.

Understanding these documents is essential for accurate payment posting and identifying any shortfalls or overpayments.

Let’s break them down:

Explanation of Benefits (EOB):

- Sent to the patient by their insurance company.

- Explains what services were billed, what was covered, how much was paid, and what the patient owes.

- Often includes reasons for non-coverage or denial if applicable.

Remittance Advice (RA):

- Sent to the provider.

- Contains similar information as the EOB but with more detailed billing and payment codes.

- Used to match payments received with the services billed.

Reconciling these documents with actual payments is called payment posting — a critical step in the revenue cycle. If the payment received doesn’t match what was expected, staff must investigate, correct errors, or follow up on underpaid claims.

This stage is also where adjustments and write-offs happen. Sometimes, due to payer contracts, the provider agrees to accept a reduced rate. Other times, uncollectible balances are written off — though this should be minimized through better front-end practices.

Efficient reconciliation ensures that the books balance, revenue is accurately reported, and any issues are addressed quickly. It’s the final financial checkpoint before closing the loop in the revenue cycle.

Revenue Cycle Management (RCM) Technology

Role of Software and Automation

Gone are the days when healthcare billing was done with paper files, manual entry, and snail-mail claims. Today, technology is the backbone of efficient Revenue Cycle Management (RCM). From scheduling and eligibility checks to coding, claims submission, and collections, software systems play a vital role at every stage of the cycle.

Practice Management (PM) systems are central to RCM. They handle everything from patient demographics to appointment scheduling, insurance verification, and billing. When paired with Electronic Health Records (EHRs), the synergy between clinical documentation and billing becomes seamless.

Automation reduces human error, improves turnaround times, and increases accuracy. For instance:

- Claims scrubbing tools can flag missing codes or incorrect data before submission.

- Auto-adjudication systems can match payments with claims instantly.

- AI-powered analytics can detect denial patterns and recommend corrections.

- Automated payment reminders can boost patient collections with minimal staff effort.

Even administrative workflows like prior authorization, eligibility checking, and payment posting are now handled by smart bots and algorithms.

What’s more, these systems are designed with compliance in mind, helping organizations meet regulatory requirements, such as HIPAA and MACRA, without added complexity.

The biggest benefit? Time. By freeing up staff from repetitive, manual tasks, RCM software lets healthcare providers focus on what they do best — treating patients.

Of course, no system is perfect. Implementation can be costly, and staff training is essential. But when used correctly, RCM technology is a game-changer in boosting efficiency, reducing denials, and accelerating cash flow.

Benefits of Electronic Health Records (EHR) Integration

Integrating your EHR with your RCM software isn’t just a luxury — it’s a necessity in modern healthcare. When clinical and financial data systems “talk” to each other, the entire revenue cycle becomes faster, smarter, and more transparent.

Here’s how EHR integration supercharges your revenue cycle:

- Improved documentation: EHRs allow providers to document patient visits in real-time, ensuring that all services are properly recorded for billing.

- Faster charge capture: With integrated systems, charges are automatically pulled from the EHR and sent to billing, reducing delays.

- Fewer errors: Integration reduces the need for manual data entry, which means fewer typos, coding errors, or mismatches.

- Real-time eligibility: Staff can check insurance coverage directly through the EHR platform.

- Automated coding assistance: Many EHRs include tools that suggest appropriate billing codes based on clinical notes.

Imagine this scenario: A physician completes a patient visit and enters notes into the EHR. Instantly, the system generates a list of appropriate codes and sends the charges to billing. Within hours, the claim is scrubbed, submitted, and ready for payment. That’s the power of integration.

And for patients, the benefits are just as important. They receive more accurate bills, faster explanations, and better service when systems are in sync.

EHR integration also supports quality reporting, value-based care metrics, and population health initiatives — all of which impact reimbursement in today’s healthcare landscape.

In short, a fully integrated EHR and RCM system isn’t just efficient — it’s essential for staying competitive.

Compliance and Regulations in RCM

HIPAA and Data Privacy Standards

When dealing with patient information and payments, security and privacy are non-negotiable. That’s where HIPAA — the Health Insurance Portability and Accountability Act — comes into play. HIPAA sets the standard for protecting sensitive patient data, especially within electronic systems used in the revenue cycle.

Under HIPAA, any organization that handles Protected Health Information (PHI) — including names, addresses, insurance details, diagnosis codes, and billing records — must ensure that this data is secure and only accessible to authorized personnel.

Some key HIPAA guidelines for RCM teams include:

- Encryption of electronic communications (emails, claim files, etc.)

- Access controls and passwords for software systems

- Audit trails to track who accessed what and when

- Secure data storage and backup

- Employee training on privacy best practices

Violating HIPAA can result in hefty fines — sometimes in the millions — and can also severely damage a provider’s reputation.

RCM vendors and software providers must also sign Business Associate Agreements (BAAs) to ensure they comply with HIPAA standards when handling patient data on behalf of providers.

But HIPAA isn’t the only regulation. Healthcare organizations must also adhere to state-specific laws, insurance guidelines, and federal mandates like MACRA, HITECH, and the No Surprises Act.

In short, compliance isn’t a checkbox — it’s an ongoing responsibility that affects every part of the revenue cycle. Providers that invest in strong compliance programs not only avoid penalties but also build trust with their patients and partners.

Importance of Regulatory Compliance

Compliance isn’t just about avoiding lawsuits or fines — it’s about doing the right thing for patients, staff, and the healthcare system as a whole.

In the world of RCM, compliance means:

- Submitting accurate claims

- Following payer rules and timelines

- Protecting patient data

- Using appropriate billing codes

- Adhering to ethical billing practices

For example, upcoding (billing for a more expensive service than was provided) and unbundling (billing separately for services that should be grouped) are considered fraudulent — and can lead to audits, penalties, or even criminal charges.

Government agencies like the Office of Inspector General (OIG) conduct audits to detect fraud and abuse. They issue compliance program guidance to help providers stay on the right side of the law.

To stay compliant, many organizations create internal audit teams that regularly review coding, billing, and documentation practices. Others hire compliance officers or invest in external consulting services.

The goal is to create a culture of compliance — one where staff understand the rules, follow them consistently, and feel empowered to report concerns.

In a nutshell, regulatory compliance isn’t just a legal necessity — it’s a cornerstone of ethical, sustainable healthcare revenue cycle management.

Measuring Performance in the Revenue Cycle

Key Performance Indicators (KPIs) to Track

If you can’t measure it, you can’t improve it. That’s why Key Performance Indicators (KPIs) are essential to maintaining a healthy revenue cycle. KPIs help providers track performance, identify bottlenecks, and uncover opportunities for increased efficiency and revenue.

Here are some of the most important KPIs in healthcare RCM:

- Days in Accounts Receivable (A/R): Measures the average number of days it takes to collect payment. A lower number indicates faster collections.

- First Pass Resolution Rate: Indicates how many claims are paid on the first submission. Higher is better.

- Denial Rate: Shows the percentage of claims denied by payers. This helps pinpoint billing or coding issues.

- Net Collection Rate: Reflects how much of the allowable reimbursement you actually collect. A high rate means you’re maximizing your revenue.

- Clean Claim Rate: The percentage of claims submitted without errors. More clean claims = fewer delays.

- Bad Debt Rate: The portion of revenue written off as uncollectible. Lower is ideal.

Tracking these metrics consistently gives healthcare leaders a data-driven view of their financial health. When KPIs slip, it’s a signal to investigate — maybe staff need training, maybe workflows are outdated, or maybe payer policies have changed.

Using dashboards and reporting tools within your RCM software can make KPI monitoring easy and transparent. These insights can then guide decisions, from staffing to technology investments.

Think of KPIs like your financial pulse. Check them regularly, act on the signs, and you’ll keep your revenue cycle in top shape.

Benchmarking and Continuous Improvement

Benchmarking is the process of comparing your revenue cycle metrics against industry standards or peer organizations. It provides context — helping you understand whether your performance is average, above average, or in need of serious attention.

For example, if the industry average for Days in A/R is 40 and your organization averages 65, that’s a red flag. Or if your clean claim rate is 70% when most hospitals hit 90%, it signals a need to optimize claim submissions.

Common sources for benchmarking data include:

- MGMA (Medical Group Management Association)

- HFMA (Healthcare Financial Management Association)

- CMS (Centers for Medicare & Medicaid Services)

Once benchmarks are identified, the next step is continuous improvement. This means:

- Regularly auditing processes

- Holding team performance reviews

- Updating training materials

- Upgrading RCM technology

- Creating a feedback loop for corrections

You don’t have to overhaul everything at once. Small improvements — like reducing denial rates by 5% or increasing patient collections by 10% — can lead to major financial gains.

Continuous improvement keeps your organization agile and resilient — especially important in a fast-changing healthcare environment where payer rules, technology, and patient expectations are always evolving.

Challenges in the Healthcare Revenue Cycle

Administrative Burdens and Staff Shortages

Running a healthcare revenue cycle isn’t for the faint of heart. One of the biggest challenges providers face today is managing the overwhelming administrative burden — especially amid chronic staffing shortages.

Billing staff are expected to handle everything from verifying insurance to correcting denials, navigating payer portals, tracking claims, reconciling payments, and educating patients — often with minimal support. Burnout is real.

On top of that, healthcare is heavily regulated. Every year brings new codes, payer policies, and compliance rules. Staying up-to-date requires constant learning and adaptation.

Many smaller practices struggle without the budget or bandwidth for full-time billing experts or advanced RCM software. This often leads to inefficiencies, backlogs, and missed revenue.

To ease the burden, providers are turning to automation, outsourcing, and centralized billing offices. These solutions can free up internal resources and reduce costs, but they come with their own set of challenges — like vendor management and data security.

In short, managing the revenue cycle requires not just technical skill, but resilience, creativity, and adaptability — especially when resources are tight.

Evolving Payer Policies and Regulations

Payer policies are like moving targets. Just when you think you’ve figured it out, a new rule, requirement, or deadline comes into play. Insurance companies frequently update coverage policies, prior authorization rules, and documentation requirements — often with little notice.

For example:

- A certain lab test may no longer be covered without a specific diagnosis.

- A telehealth visit might require a different modifier code this quarter.

- New value-based contracts might require performance reporting.

Each change can disrupt workflows, delay payments, and increase administrative overhead. If staff aren’t aware of the updates, claims get denied, and revenue takes a hit.

To stay on top of these shifts, providers must:

- Subscribe to payer newsletters and alerts

- Attend RCM webinars and training sessions

- Regularly review and update billing protocols

- Invest in payer-specific cheat sheets or guides

Also, keep an eye on government regulations. New laws like the No Surprises Act or changes to Medicare reimbursement can significantly impact billing practices.

It’s a moving puzzle — and staying informed is the only way to solve it.

Best Practices for a Healthy Revenue Cycle

Staff Training and Education

Your revenue cycle is only as strong as the people who run it. That’s why staff training isn’t a one-time event — it’s an ongoing investment in your team’s success.

Front-desk personnel, billers, coders, and RCM managers all need to be up-to-date on:

- Insurance policies and payer rules

- HIPAA and compliance regulations

- Coding updates (CPT, ICD-10, HCPCS)

- Software changes and EHR functionality

Regular workshops, online courses, certifications, and lunch-and-learns can all keep your team sharp. Encourage a culture of curiosity and professional development — the more they know, the fewer mistakes they’ll make.

Also, cross-training is a smart strategy. When staff can step into multiple roles, it prevents bottlenecks during vacations or busy periods. It also boosts morale and builds team resilience.

In a high-stakes environment like RCM, knowledge is your best defense — and your best offense.

Leveraging Analytics for Financial Health

Data isn’t just a buzzword — it’s your secret weapon for building a smarter revenue cycle. By analyzing trends, tracking metrics, and identifying weak spots, you can take targeted action to boost revenue and efficiency.

Analytics can answer questions like:

- Which services have the highest denial rates?

- Which payers are the slowest to reimburse?

- How much revenue is lost to coding errors?

- What are the top reasons for patient complaints?

Using dashboards, predictive analytics, and custom reports, RCM leaders can visualize the full picture — and zoom in on problem areas.

This isn’t about working harder — it’s about working smarter.

With the right analytics in place, you can make informed decisions, justify investments, train smarter, and get paid faster.

The Future of Healthcare Revenue Cycle

Trends in RCM Innovation

The future of the healthcare revenue cycle is fast, smart, and digital. Here are some of the trends shaping what’s next:

- AI and Machine Learning: Automating repetitive tasks, predicting denials, and improving coding accuracy.

- Blockchain Technology: Enhancing transparency, reducing fraud, and securing patient data.

- Contactless Payments: Giving patients more flexible and digital ways to pay.

- Patient Self-Service Tools: Portals that allow patients to estimate costs, view bills, and set up payment plans.

- Cloud-Based RCM Systems: Offering scalability, flexibility, and remote access for billing teams.

These innovations aren’t just nice-to-haves — they’re becoming essential for competing in a value-based, tech-driven healthcare environment.

The Move Toward Value-Based Care

Value-based care is changing everything — including the revenue cycle. Instead of being paid for each service (fee-for-service), providers are increasingly reimbursed based on patient outcomes, quality metrics, and cost efficiency.

This shift requires a different kind of revenue cycle — one that tracks quality measures, shares data with payers, and supports population health.

RCM teams now play a key role in helping organizations:

- Report quality scores

- Manage bundled payments

- Track readmissions and outcomes

- Coordinate care across multiple providers

It’s a big change, but it’s also an opportunity to create a more sustainable, patient-centered model of healthcare.

Conclusion

The healthcare revenue cycle might seem overwhelming at first — with its codes, claims, regulations, and software systems — but at its core, it’s simply about ensuring that providers get paid fairly and patients get billed clearly.

From the moment a patient schedules an appointment to the final dollar collected, every step matters. Efficiency, accuracy, compliance, and transparency all play a role in building a strong, sustainable financial foundation for healthcare organizations.

Whether you’re new to the industry or just looking to sharpen your understanding, mastering the revenue cycle is key to navigating the business side of modern medicine.