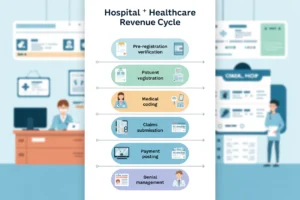

For most providers, the first real risk in the revenue cycle does not appear when a claim is submitted. It appears much earlier, when a patient is scheduled and no one has yet confirmed what the payer will actually cover. That gap between “scheduled” and “verified” is where eligibility errors, benefit misunderstandings, and preventable denials are born.

In a market with rising patient financial responsibility, aggressive payer edits, and increasingly complex benefit designs, benefit verification in medical billing has become a frontline control for cash flow, not a box to check in registration. Practices that treat it as a strategic function routinely see fewer denials, cleaner claims, and tighter time to cash. Those that do not typically watch accounts receivable age out, face uncomfortable patient conversations, and spend far more on rework than they ever would have on getting it right the first time.

This guide walks through how to design and operate a benefit verification model that is accurate, scalable, and aligned with your financial goals. It is written for practice owners, revenue cycle leaders, and billing company executives who need a practical, operations‑ready blueprint, not generic theory.

What Benefit Verification Really Covers (and Why Eligibility Alone Is Not Enough)

Many organizations say “we check eligibility” and assume that is sufficient. In reality, standard electronic eligibility responses usually tell you only whether the member is active and may include high‑level benefit information. What they do not consistently tell you is whether your specific planned services are covered, under what conditions, and with what member cost share.

A mature benefit verification process covers three distinct layers:

- Member and policy validation: Confirming the member ID, group number, plan type, coordination of benefits status, and that coverage is active on the date of service.

- Benefit structure for the service type: Confirming how the plan treats the category you are billing under, for example outpatient surgery, behavioral health, DME, therapy, or specialty drugs, including copayment, coinsurance percentage, and deductible applicability.

- Service‑specific conditions and limits: Identifying prior authorization requirements, visit limits, frequency caps, step‑therapy rules, place‑of‑service restrictions, and carveouts to other vendors or networks.

From a financial perspective, stopping at simple eligibility verification exposes you to three predictable problems: undercollected patient balances, denials for services that were never authorized or are non‑covered, and disputes when patients receive unexpected bills. For example, a hospital‑owned imaging center might confirm that a patient’s plan is active, only to discover on the back end that MRI services must go through a radiology benefit manager with separate authorization. That oversight, which could have been caught at benefit verification, often leads to write‑offs or lengthy appeals.

For executives, the practical takeaway is that “eligibility plus benefit verification” must be defined as a combined, documented control in your revenue cycle governance framework. It should have clear inputs, outputs, and quality expectations, not be left to the interpretation of individual front‑desk staff.

Designing a Benefit Verification Workflow That Actually Protects Cash Flow

High‑performing organizations treat benefit verification as an engineered workflow, not a collection of ad‑hoc phone calls. The goal is simple: by the time a patient arrives (or is admitted), you already know what will be covered, what needs authorization, and what you expect to collect at or near the point of service.

An effective workflow typically includes the following elements:

1. Trigger points and timing

Define when verification is required and how far in advance it must occur. For example:

- Elective surgeries and high‑dollar imaging: verify 5–7 business days before the scheduled date.

- Specialty office visits and procedures: verify 48–72 hours prior.

- Therapy, behavioral health, and recurring services: verify prior to the initial evaluation and then on a defined frequency (for example every 30 or 60 days or when authorizations/visit limits are close to being consumed).

By structuring timing rules, you allow staff to prioritize effort where the financial exposure is greatest and avoid last‑minute scrambles that frustrate both patients and clinicians.

2. Standardized data collection at scheduling

Benefit verification quality is limited by the data you capture upfront. Build scheduling and registration templates that enforce capture of, at minimum:

- Legal name as it appears on the card

- Date of birth and address

- Payer name and plan name

- Member ID and group number (exactly as on the card)

- Front and back insurance card images

- Referring provider, diagnosis (if known), and planned procedure or service category

Each missing or inaccurate element increases the risk of mis‑verification or downstream claim edits. Practices that measure “percentage of scheduled encounters with complete insurance demographics 3 days before DOS” often find that when this KPI is strong, denials drop in parallel.

3. Routing and ownership

Decide who owns the work. Options include front‑office teams, a centralized pre‑arrival group, or an outsourced benefit verification team. The right model depends on scale, payer mix, and scheduling volume. The critical point is to make ownership explicit, with productivity and accuracy expectations that are tracked by role, not simply by department.

Once a workflow is defined, document it as an SOP, train to it, and embed checks in your practice management system for encounters moving to “ready for provider” status without completed verification.

Choosing and Using Tools: Portals, Clearinghouses, and Automation

Technology can remove a significant portion of manual verification work, but it must be selected and governed carefully. Decisions here have direct, quantifiable impact on labor cost per encounter and denial rates.

Most organizations combine three classes of tools:

- Clearinghouse or PMS eligibility transactions: Good for confirming active coverage and high‑level benefits. Low marginal cost and fast, but usually insufficient for high‑risk services.

- Payer and plan‑specific portals: Often necessary for nuanced benefit detail and authorization rules, especially for behavioral health, radiology, and specialty pharmacy benefits that are carved out to secondary vendors.

- Automation layers: This can include robotic process automation (RPA) or AI tools that log into portals, pull structured data, and write summarized benefit records back into your system of record.

When evaluating or configuring benefit verification technology, executives should insist on the following capabilities:

- Service‑driven rules: Ability to trigger more detailed verification when scheduled CPT ranges, revenue codes, or service categories cross a dollar or risk threshold.

- Structured data capture: Output that is written into discrete fields for deductible remaining, out‑of‑pocket remaining, visit caps, and authorization numbers, not just free‑text notes. Structured data can be used for analytics and point‑of‑service estimation.

- Audit trails: Timestamped logs that show who verified what, when, and through which source. These are essential when appealing denials or auditing staff performance.

Organizations exploring AI should be realistic. AI is well suited to parse portal language, identify key benefit parameters, and recommend whether a service is coverable. It is less reliable when left entirely unattended on complex, multi‑layer payer rules. A pragmatic approach is to use automation for data gathering and summarization and maintain human review on high‑dollar or high‑risk encounters.

From Information to Action: Converting Benefits Into Upfront Collections and Fewer Denials

Verification itself does not improve cash flow unless the information reaches the right people at the right time and drives consistent financial behavior. This is where many otherwise solid verification efforts fail. Data is captured, but estimates are not produced, authorizations are not obtained, and front‑end staff are not empowered to collect.

To close that gap, leading revenue cycle teams define a clear sequence from “benefits verified” to “financially cleared.” That sequence usually includes:

- Patient responsibility calculation: Using benefit details, your historical allowed amounts, and remaining deductible/out‑of‑pocket values to estimate what the patient will likely owe for the encounter or treatment course.

- Financial counseling or scripting: A standard way to communicate expected costs, options (payment plans, discounts for prompt pay or self‑pay when appropriate), and what will be collected at or before service.

- Authorization or referral capture: Immediate initiation of required authorization based on verification findings, including tracking of expiration dates and units to avoid treat‑and‑bill denials.

- Stop‑codes or alerts: System flags that prevent encounters from moving forward to charge capture if required authorization or benefit verification is missing.

To understand whether this chain is functioning, track operational KPIs such as:

- Percentage of scheduled elective cases with documented benefit verification and patient estimate 3 days before DOS.

- Front‑desk collection rate as a percentage of total patient responsibility (by location, provider, and service line).

- Denial rate and write‑off dollars for eligibility, benefit coverage, and authorization reasons.

For example, if a cardiology group notes that 18 percent of its denials in the last quarter were tied to missing pre‑authorization, a root‑cause review often reveals that benefit verification did identify the requirement, but there was no clear hand‑off to a pre‑certification team or no system control preventing the case from proceeding without approval. Redesigning that hand‑off can eliminate a large portion of otherwise avoidable AR days and write‑offs.

Common Failure Modes in Benefit Verification and How To Prevent Them

Even organizations that “always verify” often leave money on the table due to recurring process errors. Recognizing these patterns early allows you to put targeted controls and training in place.

1. Verifying the wrong date or place of service

Plans may have different coverage rules for outpatient hospital, freestanding centers, telehealth, and office‑based procedures. Verifying benefits for an office visit and then performing the procedure in an ambulatory surgery center can produce unexpected non‑covered determinations. Require staff to confirm both date and planned place of service during verification, and design your templates to capture and display this in the verification record.

2. Ignoring secondary and tertiary coverage

In Medicare populations and among patients with COB situations, failure to identify secondary coverage leads to underbilling and unnecessary patient invoices. Ensure your workflow includes explicit prompts to ask about secondary plans and that staff understand when to perform benefit verification across multiple coverages, along with clear COB rules in your billing system.

3. Not tracking utilization against benefit limits

Benefit verification is not a one‑time event for recurring services. Therapy, ABA, psychiatric services, and some chronic care programs often have annual visit caps or require updated authorization after a set number of sessions. Build logic to trigger re‑verification or authorization checks when patients approach a defined threshold, for example at 75 percent of allowed visits. This helps avoid denials where patients exceeded limits mid‑plan year.

4. Free‑text dependency

If your verification documentation is mostly free‑text notes such as “ded met, copay 40,” you are dependent on individual interpretation and memory. This makes metrics unreliable and cross‑training difficult. Move toward structured templates and dropdowns for key elements such as copay amount, deductible remaining, coinsurance percentage, and auth status. Free text can still be used for nuances, but the core financial variables should be standardized.

Executives should periodically audit a sample of pre‑service encounters, comparing the verification record, the services actually rendered, and the final payer response. This “closed loop” review, ideally performed monthly or quarterly, surfaces patterns that simple denial coding often misses.

Staffing, Training, and Governance: Turning Verification Into a Managed Function

The quality of benefit verification in medical billing is ultimately limited by the people doing the work and the clarity of the rules they operate under. Treat it as a defined competency, not something staff “pick up” informally.

Key staffing and governance practices include:

- Role definition: Separate pure scheduling from financial clearance in medium and large organizations. Staff handling verification should have explicit financial and payer‑rules training, not only customer service skills.

- Competency‑based training: Build curricula that cover payer hierarchies, Medicare vs commercial nuances, common benefit patterns for your top 10 service lines, and reading of portal responses. Validate with practical tests, not just slide decks.

- Productivity and accuracy metrics: Track verifications completed per hour or per FTE, but always in tandem with an error rate or post‑service denial rate. High speed with high rework does not help your margin.

- Feedback loops with billing and coding: Establish a standing forum where back‑end denial trends are reviewed with front‑end teams, and workflows are adjusted based on actual payer behavior.

Many organizations augment internal staff with outsourced verification support. This can be particularly effective for off‑hours work, high‑volume blocks, or specialized payer segments. If you choose to outsource, manage that vendor with the same rigor as internal teams, including SLAs on turnaround time, accuracy thresholds, and secure access to your systems.

Measuring the Financial Impact of Improved Benefit Verification

For executives, any process investment must be justified in financial terms. Benefit verification impacts several measurable components of the revenue cycle.

Useful metrics and targets include:

- Eligibility and benefit‑related denial rate: Measure the percentage of claims denied for coverage, eligibility, non‑covered service, missing or invalid authorization, or plan limitations. Mature operations often target fewer than 2–3 percent of total claims in these categories, depending on specialty and payer mix.

- Average days in AR: Improved verification, coupled with upfront collections and correct first‑pass billing, should contribute to reductions in overall days in AR. Track in parallel with denial improvements to demonstrate cause and effect.

- Point‑of‑service and pre‑service collections: Monitor dollars collected at or before service as a percentage of total patient responsibility. Practices with robust verification and financial counseling can routinely collect 40–60 percent of patient responsibility prior to or at the time of care, particularly for elective services.

- Cost per verification: Combine labor, technology, and any outsourced vendor costs and divide by the number of distinct encounters verified. This helps you evaluate the ROI of automation investments and staffing models.

To make the impact visible, consider running a 90‑day pilot where you apply a strengthened verification protocol to one or two high‑value service lines, such as orthopedics or imaging. Track baseline and post‑pilot results for denials, write‑offs, and upfront collections. These data can inform whether to scale the model enterprise‑wide and help obtain buy‑in from clinicians and finance leadership.

Bringing It All Together: Building a Financially Reliable Front End

Benefit verification in medical billing is no longer a low‑priority clerical activity. It is a financial control point that shapes denial rates, cash flow timing, and the patient financial experience. Organizations that elevate it to a managed, measured function usually find that they can reduce rework, stabilize staffing needs, and negotiate with payers from a position of better insight.

The practical path forward is to treat verification as part of an integrated “financial clearance” program: engineer the workflows, deploy the right mix of portals and automation, standardize documentation, and hold staff and vendors to clear metrics. With these pieces in place, you create a revenue cycle where surprises are rare, patients understand their responsibility before they arrive, and payers receive claims that align with their stated rules.

If you are ready to reduce eligibility‑ and benefit‑related denials and improve predictability of cash, it may be time to redesign your benefit verification model or explore external support for high‑volume or complex payer segments. To discuss what a modern, scalable verification operation could look like for your organization, contact us and start mapping out a roadmap tailored to your payer mix, specialty, and growth plans.